Miami Home Loans FHA Loans, Jumbo Loans, HELOCs, and More

Table of Content

This is more than why American Bancshares will happily help you by navigating you through the complexities of VA mortgage loans in Miami. If you’re curious to learn about why you should choose us as well as what services we provide, then continue reading below. Even if you do belong in the Henry category and have not amassed a significant amount of wealth to purchase costly luxury property, you can probably still qualify for jumbo loans in Miami. If you have better credit scores and extensively established credit histories that are better than the average homebuyer, a jumbo loan is right for you. Borrowers facing unfortunate foreclosure issues make up the last major hard money customer group.

To find out more about home loan solutions in Miami, simply fill out the form below and one of our friendly Mortgage experts will get in touch.

Your Mortgage Made Easy

With so many lenders to choose from in the greater Miami area, and nationally, you need to choose one you can trust to find the mortgage loan that’s best for you. That huge luxury home you’ve been eyeing seems impossible to acquire. But it is completely doable when you’re approved for a jumbo mortgage loan. If you wish to learn more about why you should choose us as well as what a jumbo loan is, then continue reading below. Looking ahead to 2023, the housing market seems likely to continue to slow down.

The high-speed Brightline train is a convenient connection between Miami, Aventura and Fort Lauderdale that can allow you to keep your car parked. Troy Segal is Bankrate's Senior Homeownership Editor, focusing on everything from upkeep and maintenance to building equity and enhancing value. Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

Shoreline Mortgage

"I am dedicated to providing you with professional service and guidance throughout the mortgage process." This site is not authorized by the New York State Department of Financial Services. No mortgage loan applications for properties located in the state of New York will be accepted through this site. We have leveraged technology to bring you a simple, straightforward, online stress-free mortgage application experience.

I would definitely recommend Patty to family and friends, and look to work with her again in the future. However, the housing market is cooling off, and there is some good news if you’re trying to buy here. Inventory levels of single-family homes in Miami increased to 3.7 months of supply — still a seller’s market, but better than the limited inventory during the peak of the pandemic. Plus, Redfin data shows that fewer homes are selling for more than their list price, and more sellers are dropping their prices to attract buyers.

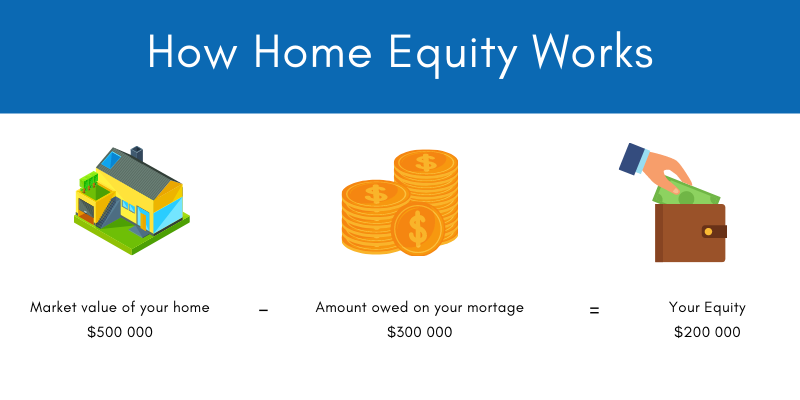

Home Equity

You need to have a minimum credit score and a certain amount of cash to qualify. In-house underwriting, processing and closing for fast approval & on time fundings. When you have this loan, you’re given a zero down payment mortgage if you’re eligible for the loan.

According to a 2009 UBS study of 73 world cities, Miami was ranked as the richest city in the United States, and the world’s seventh-richest city in terms of purchasing power. Miami is nicknamed the “Capital of Latin America” and is the largest city with a Cuban-American plurality. No matter what type of home loan you need, we’re ready to help. Generally, such individuals make a lot of money but don’t have millions in extra cash or other assets accumulated . “You wouldn’t pull out $4 million unless you really need it,” one real estate expert tells us. You or your spouse must be a veteran, active duty service member or a member of the National Guard or Reserve to qualify for a VA loan.

Is now a good time to buy a house in Miami?

Our Learning Center provides easy-to-use mortgage calculators, educational articles and more. And from applying for a loan to managing your mortgage, Chase MyHome has everything you need. A VA loan has low or no down payment options and no mortgage insurance requirement. VA loans are available with 10-, 15-, 20-, 25- or 30-year terms. 1st Florida Mortgage is your one stop shop for all your home financing needs in Miami, FL. Based in Florida, we offer home loans in throughout the state of Florida for both purchase and refinancing. While buying a house in Miami is expensive, you’ll pay a bit less for everything else compared with other cities.

If you are self employed we have a new 1 month bank statement program, no tax returns, no prepayment penalties 30 year rates rates less than 6%. However, there are cheap (or at least, not hyper-pricey) options in the metro area, and the headlines about Miami can be a bit skewed by the eye-popping price tags of the waterfront mega-mansions. If you’re looking for a reasonable place to plant roots in south Florida, read on for everything you need to know about buying a house in Miami. In spite of any perceived pitfalls, lenders provide borrowers a lifeline in their direst time of need. Consumers just need to ensure that their loan terms help them get out of debt, as opposed to worsening their situation.

Give them a call when you need help, they have very professional team ready to help you. Miami is a major center, and a leader in finance, commerce, culture, media, entertainment, the arts, and international trade. The Miami Metropolitan Area is by far the largest urban economy in Florida and the 12th largest in the United States with a GDP of $344.9 billion as of 2017.

Our American Bancshares Mortgage Miami lenders are widely known as one of the most reliable and highly established MLO in all of Miami Dade. For more than 20 years, our organization has helped to empower partners and even assist communities. And due to this, our work has extended far beyond the state of Miami. Despite our efforts to make all pages and content on 1st Florida Mortgage Lending website fully accessible, some content may not have yet been fully adapted to the strictest accessibility standards. This may be a result of not having found or identified the most appropriate technological solution.

So, if you can stomach payments from high mortgage rates, you may be able to find a better deal in Miami. Buying or selling a home is one of the biggest financial decisions an individual will ever make. Our real estate reporters and editors focus on educating consumers about this life-changing transaction and how to navigate the complex and ever-changing housing market.

Jumbo mortgage loans in Miami are made to finance luxury property and even homes that are offered in highly-competitive local real estate markets. When you apply for once, you’ll undergo more rigorous and strict credit requirements than those applying for a conventional loan. However, because of the staff’s expertise as mortgage lenders in Miami, FL, American Bancshares mortgage Miami lenders will be able to indicate if you’re eligible for a jumbo mortgage loan or not. If you possess an above-average credit score and a very low debt-to-income ratio, you might be able to qualify for a jumbo mortgage. Jumbo mortgage loans in Miami are designed to finance luxury properties and homes that are offered in highly competitive local real estate markets.

We possess leveraged technology to provide you with a simple, straightforward, online stress-free mortgage application experience. Smart Mortgage Centers holds the highest 5 star ratings with Google, Yelp, Bing and Facebook. A+ Accredited with Better Business Bureau we supply our clients with one on one customer service from start to finish. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website.

When an individual misses their mortgage payment, the lender generally provides them with an opportunity to make the loan current. While a 30-year, fixed rate mortgage is a popular conventional loan, you have other options such as a 15-year fixed rate loan or a 7/1 ARM to name a few. Think about your current budget, as well as your longer-term financial goals as you plan.

Comments

Post a Comment