Existing Home Sales Definition

Table of Content

Pending Home Sales historical data are provided by NAR solely for use as a reference. National figures and figures by all four regions, first-time affordability, and... 8.2% of homeowners in the US owe more on their mortgage than their home is worth. Show that Midwest (69%) has the highest homeownership rate overall, followed by the South (66.2%), the Northeast (61.7%), and the West (60.6%). Palm Beach, the exclusive island retreat of numerous billionaires and even the president, home sales tripled in 2020 as the affluent fled higher-tax states and cities of the Northeast. Jay Phillip Parker, CEO of Douglas Elliman’s Florida brokerage, says that it is almost impossible to find a home for sale there now.

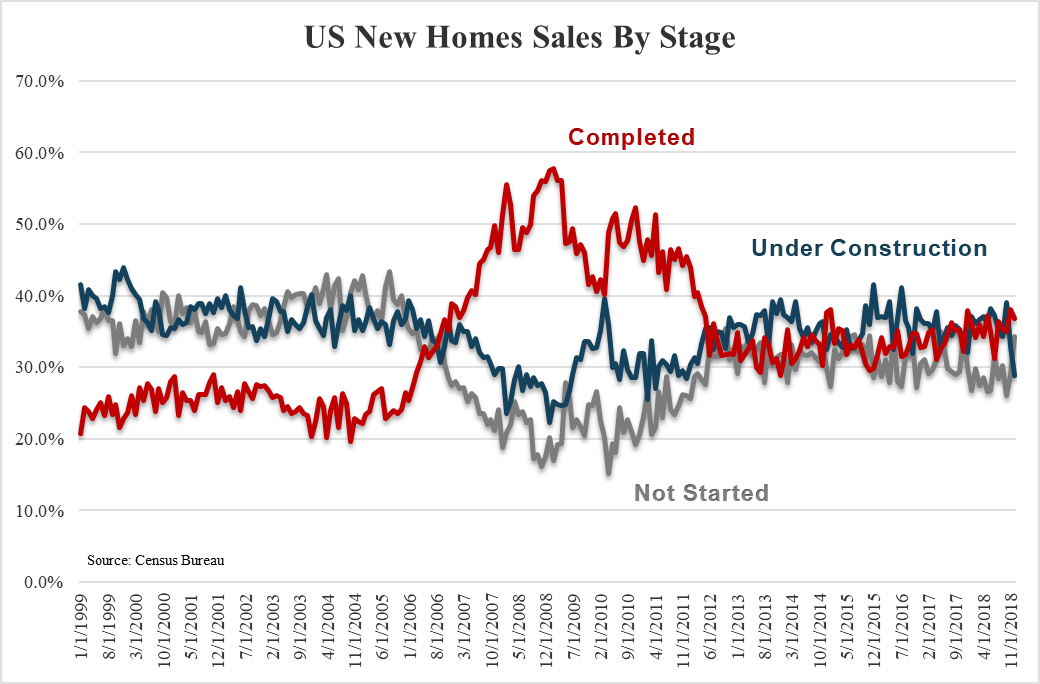

Builders continue to have very little for-sale inventory that is completed, with homes under construction comprising two-thirds of what was available in August. A house is considered sold when either a sales contract has been signed or a deposit accepted. These estimates also include houses sold while under construction or after completion. This survey does not follow through to the completion ("closing") of the sales transaction, so even if the transaction is not finalized, the house is still considered sold. About This Data The New Home Sales data above is the seasonally adjusted annual rate. Given the decline in existing-home sales, should one avoid investing in this sector?

Existing-Home Sales Dipped 7.7% in November

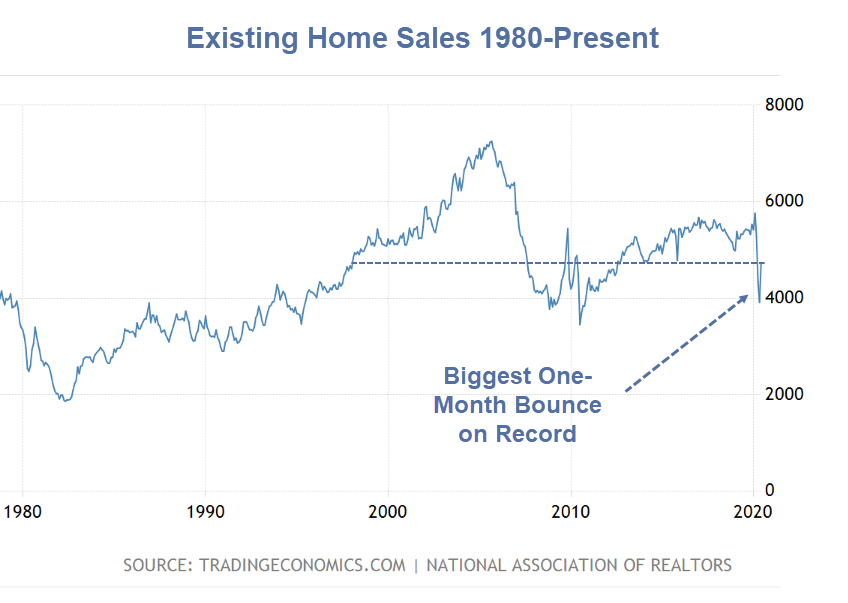

Palm Beach is among the most popular real estate markets in the world, with contracts increasing around 62% in September 2020 alone. The median price of an existing home in the west was $569,800 in November, up 2% from November 2021, NAR said. TAMPA, Fla. — Existing-home sales continued to decline for the tenth month in a row in November, according to new data from the National Association of Realtors. With persistent rate hikes from the Fed, there are widespread fears that the economy will enter a recession. The rate hikes and overall economic uncertainty have brought mortgage demand down. Existing-home sales declined for the tenth month in a row in November, according to the National Association of Realtors®.

The housing market has been under immense pressure this year as the Federal Reserve hiked interest rates to tame inflation. Higher mortgage rates have scared off potential buyers and caused sellers to either slash their listing prices or think twice about trading in their existing low rate for a new property. The one thing that would prop up real estate prices from dropping even further is that the number of new listings could go down. Factors that influence this would be people choosing not to sell if they’re satisfied with their current fixed mortgage rate, or if they feel the new selling point wouldn’t be worth it.

Over 60% of homes went off-market in two weeks

The County Median Home Prices and Monthly Mortgage Payment indicates median home values for 3,119 counties and county-equivalents in the United States. Its calculation comes from comparing the House Price Index growth from Federal Housing Financing Agency to the latest housing data from the American Community Survey. The bureau defines a new home sale as the signing of a home sales contract, or the acceptance of a deposit.

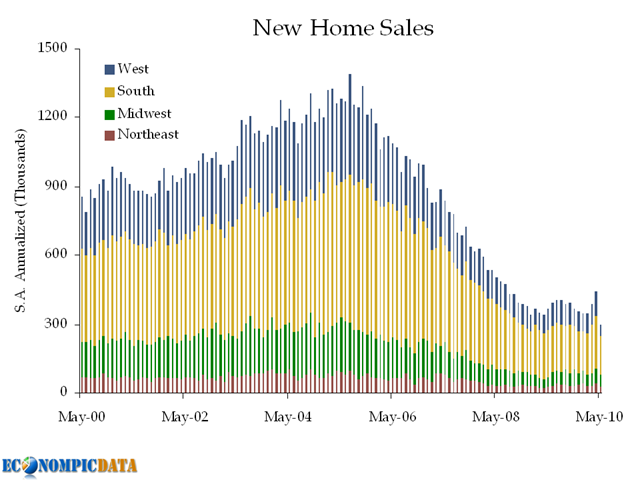

New homes sales dropped for the fourth consecutive month in April, to the lowest level in two years, closing in on the quarantine-low of April 2020. High construction costs and surging mortgage rates are keeping many buyers away this spring. A total of only 591,000 homes sold during the month, a 16.6% decline from a downwardly-revised March figure, driven by declines in all major regions of the country. Begin to level off in July, the median sales price of new homes ticked up to $439,400, up 5.9% month-over-month and 8.2% year-over-year. Mortgage rates concluded the month around 5.3%, 2.5 percentage points higher than one year earlier, making this jump in price even more impactful.

Mortgage rates dropped to 2.65%

This data is among the important housing and economic indicators that reports the sales of newly constructed residences in the country. Analysts can use these stats in conjunction with the Pending Home Sales Index to get a clearer picture of the progression and state of the current housing market. The following statistics will give you some insight into theUS real estate market. Realtor.com says the median new mortgage payment went up about $1,000 in October compared to a similar property purchased in 2019. This means that new homeowners are finding themselves with higher mortgage payments that are significantly impacting their monthly budgets.

Mortgage rates have dipped in recent weeks, giving experts some hope that the market may be thawing. Q.ai helps you invest like the pros with advanced investment strategies that combine human ingenuity with AI technology. Our strategies, packaged into Investment Kits, identify trends and predict market changes, ultimately helping investors manage risk and maximize returns. Invest in up to 20 stocks and ETFs by adding a single Kit to your portfolio. From there, our AI will rebalance your investments on a weekly basis to optimize performance. All you have to do is add the Kit and leave the rest to us.Download Q.aitoday to start investing.

Investors purchased nearly 1 in 5 of all homes sold in the U.S.

As the graph shows, appreciation has remained steady at around 18% over the last five months. Home prices are still “extremely elevated by past standards” and are likely to slide by “a further 15 to 20%” over the next year, according to Clancy. Realtor.com recently updated its forecast for 2022 home sales, now projecting fewer this year than last year. This guide is based on the data from the year listed, the 2022 report is the latest version available.

In 2019, 98% of final prices matched the initial asking price of a new property . Recent sales of new homes in the US decreased by 0.4% from November to December 2019. As such, this region is the top market contributor followed by the Midwest with 1.30 million sales.

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future. The rewards of building the houses and communities that people call home are immeasurable. The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index tracks the changes in the overall value of the U.S. residential market over time.

Housing units, as distinguished from "HUD-code" manufactured homes, include conventional ``site-built'' units, prefabricated, panelized, componentized, sectional, and modular units. The average, or arithmetic mean, sales price is obtained by dividing the sum of all the sales prices reported by the number of houses reporting a sales price. Moreover, the home builders industry enjoys a good Zacks industry rank (Top 8% out of 256 industries). The industry has outperformed the broader market (S&P 500) year-to-date as well.

After almost two years of double-digit increases, many experts thought home price appreciation would decelerate or happen at a slower pace in the last quarter of 2021. However, the latestHome Price Insights ReportfromCoreLogicindicates while prices may have plateaued, appreciation has definitely not slowed. The following graph shows year-over-year appreciation throughout 2021.December data has not yet been released. “Now the housing market will go through the other side of that and hopefully come out in a better place between supply and demand,” Powell added.

So it’s a good indicator of economic well-being due to its consumer income sensitivity. Normally, when economic conditions slow down, new home sales serve as an early indicator of a depression. As you can see from the chart above, new and existing home sales picked up after 2011, when the economy also started to show positive momentum.

Understanding Existing Home Sales

These real estate figures are confusing, as the lagging indicators still show high prices, but current data show that this trend is reversing somewhat. Sales are slowing down, but the prices have a lot to drop before they become affordable once again. Census Bureau’s series on new single-family home sales, which are based on contracts or the acceptance of a deposit. Because of these differences, it is not uncommon for each series to move in different directions in the same month.

Comments

Post a Comment